Hello, and welcome. As a specialist in the automotive digital market for over 5 years, I’ve seen one question cause more confusion for Tanzanian car buyers than any other: "Why is the final price of my car so much higher than the advertised price?"

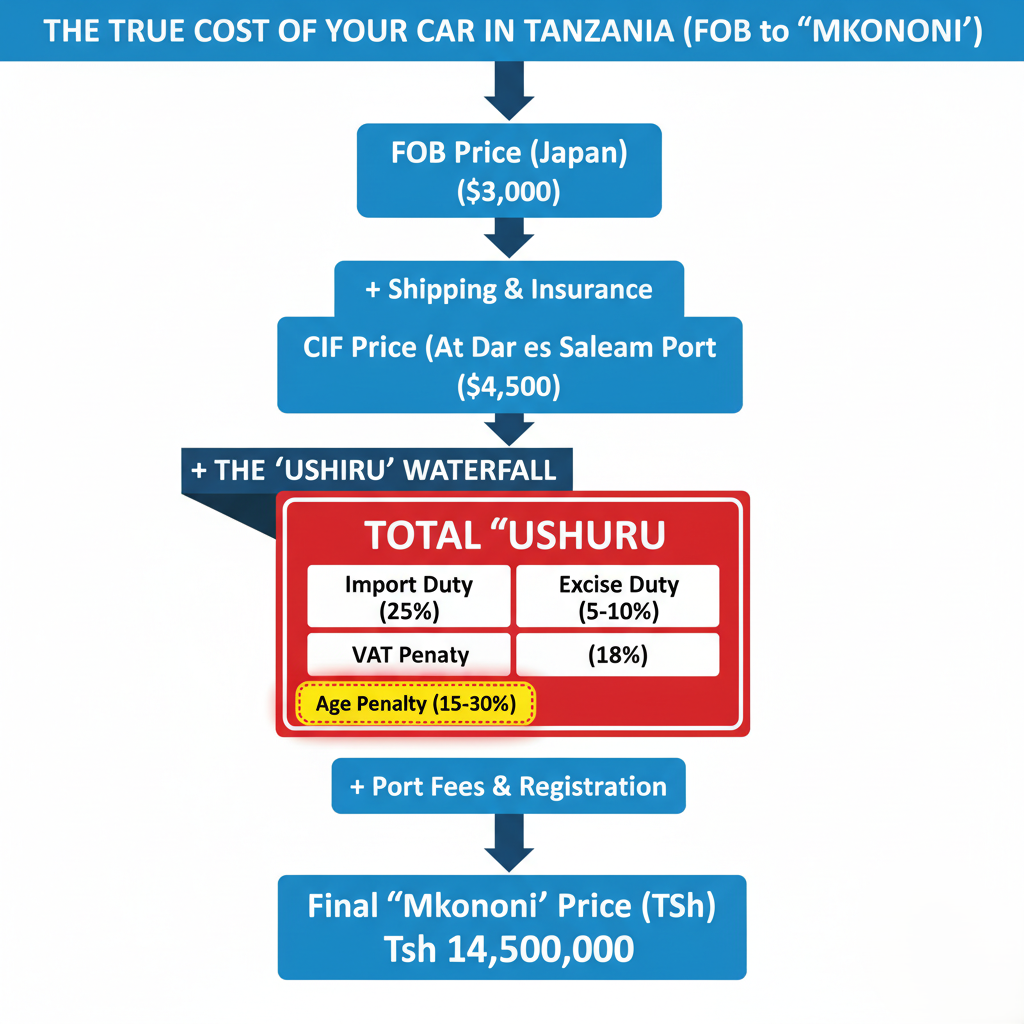

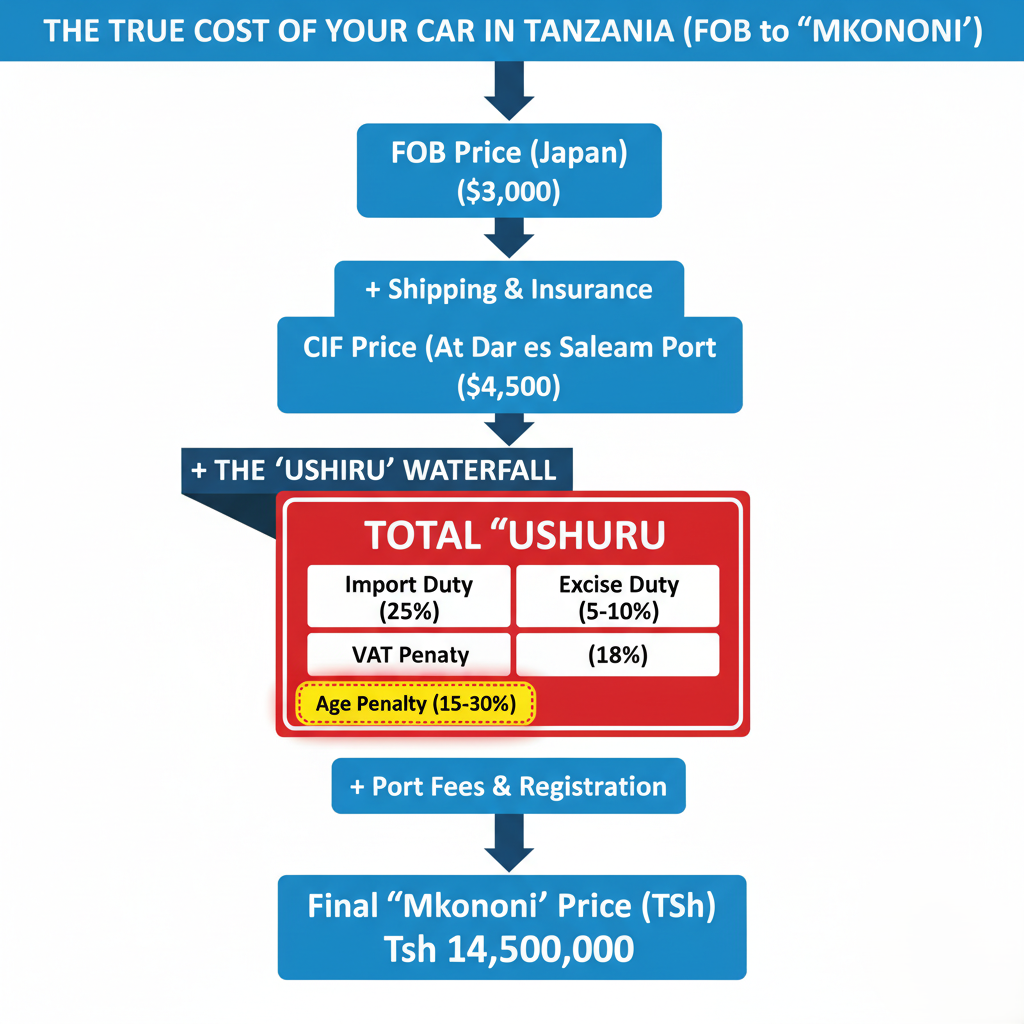

You see a Toyota Vitz online, advertised from Japan for $1,500. You get excited. But by the time it’s in your hands in Dar es Salaam, the final price mkononi (in-hand) is TSh 14,500,000. This isn't a scam; it's a complex and often opaque system of import taxes, duties, and fees. The advertised price isn't the real price.

The price tag you see online is just the beginning. The real cost is hidden in a complex system known as 'ushuru', a cascade of taxes that can double the price of your vehicle.

This guide is here to eliminate that confusion. I am going to provide you with a complete, step-by-step breakdown of every cost. We will demystify the 'ushuru' system, show you how to calculate the total price of a car in Tanzania, expose the costly "traps" to avoid, and empower you to buy your next car with 100% confidence. This is the definitive guide to car prices in Tanzania for 2025.

Why the Sticker Price Isn't the Real Price: FOB vs. CIF vs. 'Mkononi'

The first step to becoming a smart car buyer in Tanzania is learning the language of import pricing. The single biggest source of confusion is the "two-price" problem: the price you see advertised by an exporter in Japan and the price you pay in Tanzanian Shillings.

Let's break down the three terms you must know.

Understanding FOB (Free On Board)

When you browse a Japanese exporter's website, the low price you see is almost always the FOB price.

What it is: This is the price of the car in Japan. It includes the vehicle's cost and the cost of transporting it to the Japanese port (like Yokohama or Nagoya).

What it is NOT: It does not include shipping, it does not include insurance, and it absolutely does not include any Tanzanian taxes.

The FOB price is a "bait" price. It's useful for comparing the base value of two cars from the same exporter, but it is not the cost to get the car to Tanzania.

Understanding CIF (Cost, Insurance, Freight)

The second, more important price is the CIF value. This is the number that most of your taxes will be based on.

What it is: This is the total cost to get the car from Japan to the Port of Dar es Salaam. As the name implies, it is the FOB price (Cost) + Insurance (to protect the car during transit) + Freight (the cost of sea transport).

What it is NOT: This is still not your final price. This is the price of the car sitting on the dock in Dar es Salaam, before the Tanzania Revenue Authority (TRA) has inspected it and before a single Shilling of 'ushuru' has been paid.

The All-Important 'Mkononi' (In-Hand) Price: What It Really Means

This is the only number that truly matters to you as a buyer. The mkononi price is the total, final, drive-away cost.

CIF Price + All 'Ushuru' (Taxes) + Port Fees + Registration = Final 'Mkononi' Price

Let's look at a real-world example from a local classified. A 2011 Toyota Vitz is listed with its import breakdown:

CIF Price: "CFR 3,100 $ (7.6ml tsh) till Dar es salaam"

Final 'Mkononi' Price: "Plus ushuru ita cost: 14.5ml mkononi"

Think about that. The car's value (CIF) was TSh 7,600,000. The tax on that car was TSh 6,900,000. The 'ushuru' was nearly 91% of the car's value. This "Ushuru Gap" is the critical piece of information most first-time buyers are missing.

The Ultimate Guide to 'Ushuru': Calculating Tanzania's Car Import Taxes

Now we get to the most important section of this guide: how to calculate car import duty in Tanzania. 'Ushuru' is not a single tax. It's a "tax cascade," where each new tax is applied to the total of the previous ones. This compounding effect is why the final bill is so high.

Here is your step-by-step guide.

Step 1: The TRA's Used Motor Vehicle Valuation System (UMVVS)

This is the most important insider tip I can give you. The TRA does not use the seller's invoice to calculate your tax. Why? To prevent people from faking low invoices to pay less tax.

Instead, the TRA uses its own database: the Used Motor Vehicle Valuation System (UMVVS).Before you even shop for a car, you must go to the TRA's UMVVS portal. Here, you will enter the Make (e.g., Toyota), Model (e.g., RAV4), Year of Manufacture, Engine Size, and Fuel Type.4 The system will then tell you the official "dutiable value" of that car. This value and only this value is the starting point for all tax calculations.

Step 2: Calculating Import Duty (25%)

This is the first and most straightforward tax. The East African Community (EAC) Common External Tariff sets a 25% Import Duty on all imported vehicles.

Calculation: $25% of the UMVVS Value

Step 3: Calculating Excise Duty (Based on Engine Size)

This is the second tax, and this is where the cascade begins. Excise Duty is based on your car's engine size (cylinder capacity).This is not 5% of the UMVVS value. It's 5% of the UMVVS value plus the Import Duty you just calculated.

Calculation: $5% or $10% of (UMVVS Value + Import Duty)

Step 4: Adding Value Added Tax (VAT) (18%)

This is the final, and largest, tax in the cascade. The VAT rate in mainland Tanzania for imported goods is 18%. (Note: some sources may quote 20%, but 18% is the standard rate for mainland Tanzania).

This 18% is calculated on the grand total of everything that came before it.

Calculation: $18% of (UMVVS Value + Import Duty + Excise Duty)

Let's visualize this cascade in a simple table.

Table 1: The 'Ushuru' Calculation Waterfall (2025)

Step | Tax / Fee | Standard Rate |

1 | Base Value | (Variable) |

2 | Import Duty | $25% |

3 | Excise Duty | $5% or $10% |

4 | VAT | $18% |

This is before we add the most expensive mistake of all: the age penalty.

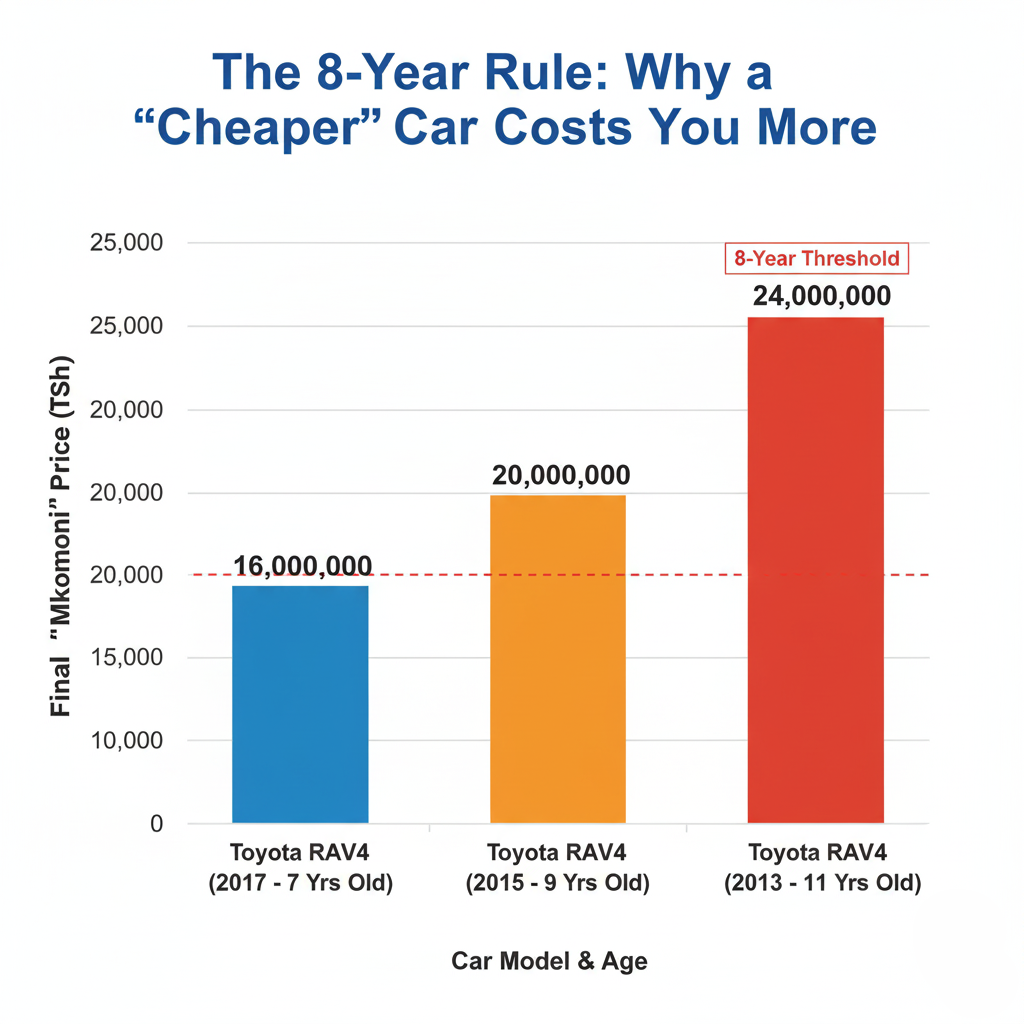

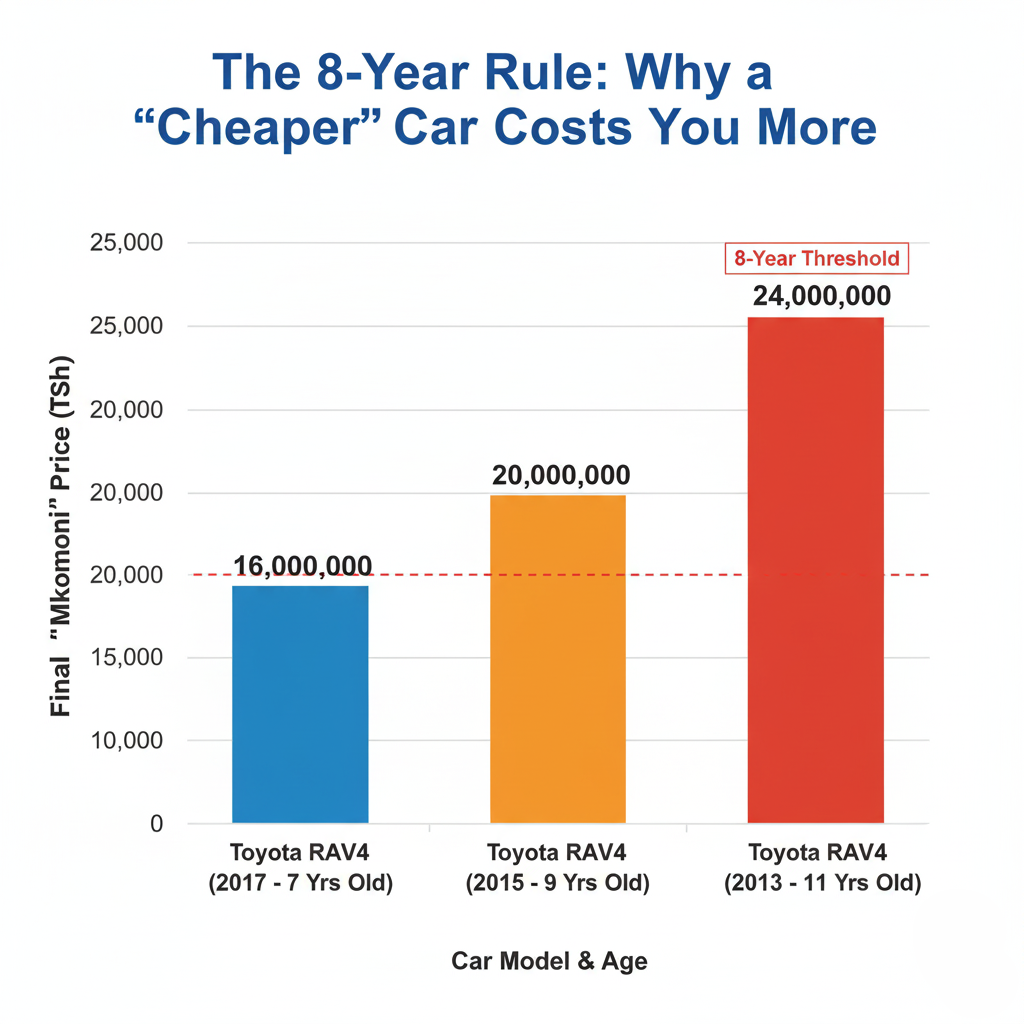

The Biggest Mistake Buyers Make: The Vehicle Age Penalty

If you learn only one thing from this guide, let it be this: Do not import a car 8 years old or older without knowing the massive financial penalty you will pay.

Tanzania has an "8-Year Rule". While it's not an age restriction (you can still import older cars), it's a severe financial deterrent. This rule adds an additional excise duty on top of all the taxes we just calculated.

The 8-10 Year Rule: The 15% Additional Excise Duty

If a vehicle is aged 8, 9, or 10 years from its original year of manufacture, it is charged an additional $15% excise duty. This is a massive, instant price increase.

The 10+ Year Rule: The 30% Dumping Fee

If a vehicle is 10 years old or older, the penalty is catastrophic. It is charged an additional $30% excise duty is charged, often called a "dumping fee".

How This Penalty Drastically Changes a Car's Final Price

This is what I call the "False Economy Trap." A buyer sees a 2013 Toyota Harrier (10+ years old) for $7,000 FOB and a 2016 Toyota Harrier (7 years old) for $9,000 FOB. They think they are saving $2,000. The 2013 Harrier will be hit with a 30% penalty on its entire dutiable value. The 2016 Harrier will pay zero penalty. When all taxes are calculated, the older, "cheaper" car will almost certainly be more expensive 'mkononi' than the newer model.

Expert Tip: For 2025, the "safe" manufacturing years to import are 2017 and newer. A 2016 model may be safe for part of the year, but a 2015 model will absolutely incur the 15% penalty. This is a non-negotiable financial trap.

Table 2: The Vehicle Age Penalty (Additional Excise Duty)

Vehicle Age (From Manufacture Year) | Additional Excise Duty Rate (On Dutiable Value) |

0 - 7 Years | $0% |

8 - 10 Years | $15% |

10+ Years | $30% |

2025 Price Guide: Popular Used Cars in Tanzania (Total Landed Cost)

Now, let's apply everything we've learned. You want to know the cheap Japanese used cars in Tanzania and what their real 'mkononi' price is. Below are 2025 estimates for popular models. These are not quotes, but realistic "in-hand" price ranges in TSh, assuming you import a "safe" model (under 8 years old) and after all 'ushuru' and fees are paid.

Budget City Cars (Toyota Vitz, Honda Fit, Nissan Note)

These are the most popular cars for first-time buyers, students, and navigating the busy streets of Dar es Salaam. Their small engines (1000cc-1500cc) put them in the lowest $5\%$ excise duty bracket, and their fuel efficiency is a top priority. The Honda Fit is especially known for its roomy interior, while the Nissan Note is a practical, affordable option.

Estimated 'Mkononi' Price Range (2016-2018 models): TSh 14,000,000 – TSh 19,000,000

Popular Sedans (Toyota Premio, Toyota Allion)

These are the undisputed workhorses of Tanzania. You see them everywhere for a reason: they are incredibly reliable, comfortable, parts are available everywhere, and they hold their resale value well. They typically have 1500cc-1800cc engines, keeping them in the low $5% tax bracket.

Estimated 'Mkononi' Price Range (2015-2017 models): TSh 28,000,000 – TSh 38,000,000

Top-Selling SUVs (Toyota RAV4, Nissan X-Trail, Toyota Harrier)

This is the aspirational-but-practical category. These cars are perfect for families, offer better safety, and can handle Tanzania's diverse terrain, from city streets to upcountry roads. The Toyota Harrier price in Tanzania is a common search, but be careful: many models are over 2000cc, placing them in the higher $10% excise bracket. The Nissan X-Trail price in Tanzania is often more competitive, offering similar SUV comfort.

Estimated 'Mkononi' Price Range (2013-2015 models): TSh 45,000,000 – TSh 65,000,000+

The Indestructibles (Toyota Land Cruiser Prado, Toyota Hiace)

These vehicles are in a class of their own. The Toyota Hiace is the backbone of commercial and large-family transport, valued for its durability and massive space. The Toyota Land Cruiser Prado is a status symbol and a truly capable off-road machine, renowned for its robust build.Their large engines and high UMVVS values mean their final 'mkononi' price is substantial.

Estimated 'Mkononi' Price Range (2010-2014 models): TSh 80,000,000 – TSh 150,000,000+ (Note: these models often fall into the age penalty brackets, which is factored into this higher estimate).

Table 3: 2025 Popular Used Car Price Guide (Estimated Total 'Mkononi' Cost)

Model (Avg. Year) | Category | Avg. CIF Price (USD) | Est. Final 'Mkononi' Price (TSh) |

Toyota Vitz (2016) | City Car | $3,500 - $4,500 | TSh 14.5M - 19M |

Honda Fit (2016) | City Car | $4,000 - $5,000 | TSh 16M - 20M |

Toyota Premio (2014) | Sedan | $7,000 - $8,500 | TSh 29M - 36M |

Toyota Allion (2014) | Sedan | $7,000 - $8,500 | TSh 29M - 36M |

Toyota RAV4 (2013) | SUV | $8,000 - $9,500 | TSh 45M - 55M |

Nissan X-Trail (2014) | SUV | $7,500 - $9,000 | TSh 42M - 52M |

Toyota Harrier (2012) | SUV | $8,500 - $10,000 | TSh 48M - 60M |

Toyota Land Cruiser Prado (2010) | 4x4 | $12,000 - $15,000 | TSh 85M - 110M (Incl. Age Penalty) |

Importing vs. Buying Locally: Which Is Cheaper and Safer?

You have three main options for buying used cars in Tanzania, each with a very different balance of price, risk, and convenience.

The Risk & Reward of Importing Directly

This involves you, the buyer, finding a car on a Japanese portal (like Be Forward or SBT Japan ), paying them the CIF price, and then hiring a clearing agent in Dar es Salaam to handle the complex 'ushuru' and port clearance process.

Reward: You can cut out the local dealer's markup, potentially saving money.

Risk: This is the highest-risk option for a new buyer. You are responsible for the entire complex tax calculation. If your clearing agent is dishonest, you can overpay. Most importantly, the car arrives "as-is." If it has hidden "mechanical failures," you have "little recourse".

The Risk & Reward of "Street-Corner" Dealers

This is what the industry calls the "unorganized" sector. These are the numerous physical car lots you see, often with "cash-heavy" operations.

Reward: It's fast and immediate. You can see, touch, and test drive the car today.

The "Transparent Import" Model: Using a Verified Partner

This is the "organized" sector, a modern solution that balances the other two. In this model, a trusted, transparent company acts as your local partner. They handle the entire process: sourcing in Japan, inspection, shipping, and all TRA tax and customs clearance, and they present you with one final, all-inclusive 'mkononi' price.

This model is growing fast because it directly solves the modern Tanzanian buyer's biggest demands: "information transparency," "quality assurance," and "verified inspection records".You get the price benefit of a direct import with the safety and trust of a professional dealer.

Quick Takeaways: Your 7-Point Car Buying Checklist

Here is a simple checklist to save you time and money.

Always use the TRA's UMVVS to find the true dutiable value of your target car before you buy.

Budget for 'Ushuru': Your final 'mkononi' price will likely be 50-65% (or more) higher than the CIF price, depending on the engine size.

The 8-Year Rule is Critical: In 2025, avoid manufacturing years of 2016 or older unless you have budgeted an extra 15-30% of the car's value for the age penalty.

Prioritize Popular Models like Toyota and Nissan. Their popularity means spare parts are cheap and mechanics everywhere know how to fix them.

Choose Your Buying Channel Wisely: Balance the high risk of "street-corner lots" against the complexity of solo importing.

Demand Inspection: Do not buy a car without a JEVIC certification. This is your only guarantee of authentic mileage and roadworthiness.

Think 'Mkononi': The only price that matters is the final "in-hand" price, with all taxes paid.

Why Smart Buyers Choose Carbarn Tanzania

You've now seen how complex and risky buying used cars in Tanzania can be. You face confusing taxes, hidden penalties, and a high risk of poor-quality vehicles from "unorganized" dealers. This is precisely why Carbarn Tanzania was created: to be the transparent, reliable solution that eliminates all of these problems. We are one of the best car importers in Tanzania because we are built on trust.

Here is how we solve your biggest challenges:

1. We Solve the 'Ushuru' Problem

Your biggest fear is the unknown tax bill. We eliminate it. Carbarn Tanzania provides all-inclusive pricing with no hidden costs.The price you see on our website is the final 'mkononi' price. We handle the complex UMVVS calculations, the 25% Import Duty, the 5-10% Excise Duty, and the 18% VAT. There are no surprises, ever.

2. We Solve the Quality & Trust Problem

Tired of "inconsistent vehicle quality" from street-corner lots? We guarantee our quality. Every single vehicle we source is JEVIC-certified. This is the mandatory Japanese inspection that verifies the car's true mileage, structural integrity, and roadworthiness, ensuring you get a safe, reliable vehicle.

Furthermore, we offer a level of transparency you won't find anywhere else. Every car comes with two inspection reports:

The official Japanese Auction Sheet, so you can see its original condition.

A secondary, detailed Carbarn Inspector Report.

3. We Make the Entire Process Easy

Importing a car yourself is a logistical nightmare of paperwork and tracking. We manage the transparent import, customs, and delivery process for you.From our secure sourcing in Japan to the port in Dar es Salaam, your personal Carbarn dashboard gives you full visibility. You can download invoices, inspection sheets, and even track your vessel's progress and shipping status live.

This is the new, smart, and safe way to buy a car in Tanzania.

Conclusion: Buying with Confidence in 2025

The car price in Tanzania is no longer a mystery. As we've seen, the final 'mkononi' price is a complex but knowable figure. The secret lies in understanding the "three Cs":

The CIF price (your starting value).

The Cascading 'Ushuru' calculation (Import Duty + Excise Duty + VAT).

The Critical 8-year age penalty (the 15-30% trap).

For too long, this complexity has created a market full of skepticism and risk. But armed with this knowledge, you can now navigate the process like an expert. You know to check the TRA's UMVVS, you know to budget 50-65% or more for taxes, and you know that a 7-year-old car is often a better financial decision than a 10-year-old one.

Buying a car should be an exciting, proud moment, not a stressful gamble. By calculating the total 'mkononi' price yourself or by partnering with a transparent importer who guarantees that price for you, you can finally avoid the costly mistakes and drive away with confidence.

Your journey to a new car starts with trust. Stop guessing. Start driving. Browse our selection of JEVIC-certified, fully inspected vehicles at Carbarn Tanzania today. Know your exact 'mkononi' price before you commit. Click here to see our all-inclusive price arrivals.